Barclays' Structured Product Linked to a Basket of ETFs and Indexes

(Mar 2013)

RISK.net recently posted an article entitled "IWM urges investors to think about risk-adjusted returns" in the structured products portion of their website. The article describes in detail a Barclays product for which Institute for WealthManagement, LLC (IWM) served as the basket selection agent. Interestingly, the basket is composed mostly of ETFs, which have been appearing in structured products more frequently as the ETF industry itself has become more mature. IWM's Matt Medeiros talked...

Apple's Declining Stock Price and Structured Products

(Jan 2013)

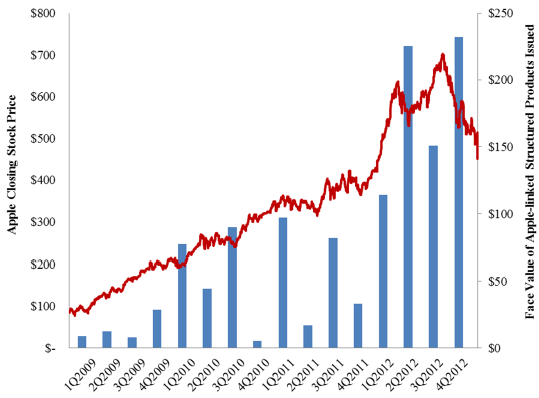

Jason Zweig at the Wall Street Journal has an excellent piece on a part of the Apple story that hasn't gotten much press: many equity-linked structured products are linked to the common stock of Apple.

SLCG has recently completed an analysis of the market value of outstanding structured products linked to Apple common stock (AAPL). In the following figure, we plot the total quarterly issuance of AAPL-linked structured products in our database since the first quarter of 2009.

As Apple's common...

What a CDO 'Resurgence' Might Mean for Investors

(Jan 2013)

Kaitlin Ugolik at Law360 had an article on Wednesday discussing the recent "bump in demand for collateralized debt obligations." CDOs are complex derivatives that pool assets together and split the risk of that portfolio into tranches which are then sold to investors. CDOs have been implicated in the financial crisis of 2008 and have seen a strong drop-off in new issuances since, though that tide may now be changing.

According to the article, some lenders are predicting a large increase in...

European Traders May Face Financial Transaction Tax

(Jan 2013)

Earlier this week, eleven European countries were given the green light to implement a financial transaction tax according to an article from the Associated Press (AP). The story was subsequently picked up by the Wall Street Journal (WSJ).

According to the AP, the European Commission proposed "that trades in bonds and shares be taxed at 0.1 percent and trades in derivatives at 0.01 percent." Since these taxes will be based upon notional values for derivatives, the tax could be a large...

IBM Switches to Annual 401(k) Contributions

(Dec 2012)

The Associated Press recently posted a story concerning IBM's effort to cut costs by switching from regular contributions to employees' 401(k) accounts on each paycheck to a lump-sum contribution at the end of each year. This move, clearly in the best interest of shareholders, has real and significant implications to the 401(k) accounts of IBM employees. According to the article, only a minority of companies use this type of arrangement.

About 7 percent of employers offering 401(k)s make...

Happy (We Hope) Madoff Day

(Dec 2012)

It was four years ago today that Bernie Madoff was arrested for perpetrating his estimated $65 billion fraud. Coming right on the heels of the SEC and FINRA's year-end investor warnings, Paul Sullivan at the New York Times has suggested that December 11 should be declared Madoff Day, where we reflect upon how to protect ourselves from investment fraud.

Protecting yourself against fraud, or simply bad advice, is easier said than done. The most common advice is to make sure your money is held...

Attractive Yields and Hidden Risks

(Dec 2012)

The Wall Street Journal had a great piece this weekend concerning the investments some investors are seeking out to find yield in this low interest rate environment. Investors are taking on more and more risk to realize the yield they once found commonplace and this article brings a few examples to the forefront.

The risk investors are taking include credit risk (high-yield/junk bonds), market risk (closed-end funds trading at a premium) or some combination of the two (structured products)....

Dual Directional Structured Products are Risk.net's "Trade of the Month"

(Nov 2012)

Last week a UK firm called Meteor launched a "Bull and Bear Growth Plan" linked to the FTSE 100 that has a payoff similar to a structured product that has garnered significant interest recently: Dual Directional Structured Products (DDSPs). Dual directional products are Risk.net's 'Trade of the Month', and they have chosen this issue as their featured product.

Generically speaking, DDSPs pay out a positive return if the underlying index or stock linked to the product changes in value...

Back to the Future: Stock Prices Quoted with Fractions

(Nov 2012)

The Wall Street Journal recently reported that the SEC is considering reverting back to an old system in which stock prices were quoted using fractions. Using fractions for stock prices in the US has its roots in a Spanish colonial currency whose smallest denomination was 1/8 of a doubloon, hence prices were quoted in eights. The NYSE, founded in 1792 within the Buttonwood agreement, modeled their listing system off the Spanish system.

The largest number used for the denominator in the...

The Effects of ETF Turnover

(Oct 2012)

Lately there has been a lot of turnover in exchange-traded funds (ETFs), as we noted back in August. InvestmentNews has a great summary of what has happened this year, with 86 funds having closed so far in 2012. They note the important consequences of an ETF closing for investors and advisers:

Even though they are more routine, ETF closings still can create ripple effects that reach financial advisers and their clients. "For an adviser, the worst thing that can happen is, you recommend an ETF...