Structured products: 2011 year-end market review

(Jan 2012)

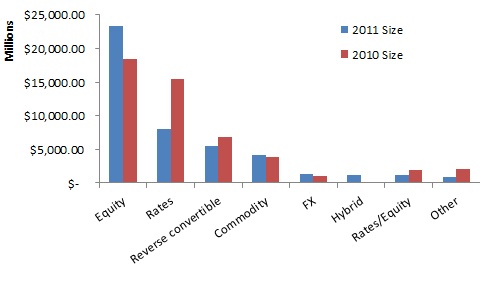

2011 was another big year for structured product sales both in the US and abroad. According to Bloomberg's year end totals, almost $45.5 billion worth of SEC registered structured products were sold in the US in 2011, down only slightly from $49.4 billion in 2010. There were 7,293 individual products sold, up from 6,443 a year earlier.

The number of products linked to interest rates decreased, which was made up for with increases in products linked to equity assets.

Sales in Europe grew...

What are 'structured products', anyway?

(Jan 2012)

By Tim Husson, PhD

We've done a lot of work on structured products. And I mean a lot. In addition to our research on valuation and suitability issues, we've devoted a section of our website to informing investors about different types of products, as well as Tear Sheets evaluating several thousand structured products released over the past couple years. We have found that most structured products are issued at a substantial premium, and that many investors (especially retail investors) do...

Welcome to the new SLCG blog

(Jan 2012)

At SLCG we encounter a lot of complex investment strategies and interesting financial products. We have traditionally written up our findings into research articles and published them in peer-reviewed academic journals, but lately we've realized that there are too many interesting topics to devote an entire research project to each and every one.

We support the dissemination of information that can inform and educate everyday investors of both old and new financial products. It would be...

SLCG Research: Average Credit Quality

(Aug 2011)

SLCG released today 'What Does a Mutual Fund's Average Credit Quality Tell Investors?'

Bond mutual funds often report an "average credit quality" in their marketing materials. A fund's average credit quality is represented by a rating (e.g. A, A-) that is based on the credit ratings of the fund's individual securities, and these credit ratings come directly from rating agencies such as Standard and Poor's and Moody's.

In this paper, we explain a methodological flaw in the way average...

SEC Press Release: Structured Products

(Jul 2011)

SEC Staff Issues Summary Report of Sweep Examination of Structured Products Sold to Retail Investors

The Securities and Exchange Commission (SEC) issued a press release today announcing that it had

"issued a report identifying common weaknesses seen in sales of structured securities products and describing measures by broker-dealers to better protect retail investors from fraud and abusive sales practices."

The report is a result of studies in the structured products business of...

SEC Press Release: New Short Form Criteria

(Jul 2011)

SEC Adopts New Short Form Criteria to Replace Credit Ratings

The Securities and Exchange Commission (SEC) issued a press release today announcing that it had removed "credit ratings as eligibility criteria for companies seeking to use 'short form' registration when registering securities for public sale." The SEC unanimously voted for the adoption of this new rule, in response to the Dodd-Frank Wall Street Reform and Consumer Protection Act that encouraged financial regulators to rely...

FINRA Investor Alert: Asking the Right Questions

(Jul 2011)

The Grass Isn't Always Greener-Chasing Return in a Challenging Investment Environment

The Financial Industry Regulatory Authority (FINRA) published an Investor Alert to help retail investors, who are seeking for higher returns through investing in complex securities such as structured products, ask the right questions before making such investment decisions.

Investors are encouraged to read through the FINRA article. The article includes a section on 'Structured Retail Products', since...

In the News: UBS & Morgan Stanley Subpoenaed over Reverse Convertibles

(Jul 2011)

UBS, Morgan Stanley Subpoenaed Over Reverse Convertibles

Bloomberg news reported today that the state of Georgia had sent subpoenas requesting for data and other information from UBS AG, Morgan Stanley and Ameriprise Financial Inc.. The state is investigating whether these brokerage firms violated the securities laws of Georgia in their sale of reverse convertibles to investors of Georgia.

Sales of reverse convertibles have grown, and investors who are being sold these structured...

Dishonest Sales of LEFTs by RBC Capital Markets

(Jul 2011)

Secretary Galvin Charges RBC Capital Markets and Agent with Dishonest Sales of Leveraged and Inverse Leveraged Exchange Traded Funds

The Enforcement Section of the Massachusetts Securities Division of the Office of the Secretary of the Commonwealth alleges that Michael Zukowski, a registered representative of RBC Capital Markets, made "numerous unsuitable recommendations and sales" of leveraged and inverse leveraged exchange traded funds (ETFs) to clients who did not understand the risks...