The study on "How Widespread and Predictable is Stock Broker Misconduct?" by SLCG, past customer complaints against individual brokers can serve as predictors of future complaints. McCann, Qin, and Yan's research shows that incorporating the complaint histories of co-workers greatly enhances the ability to predict complaints against brokers with no previous complaints. They also established that customer complaints that were denied, rather than just settlements and awards, are valuable for anticipating future investor harm.

Egan, Matvos, and Seru's findings validate that instead of purging problematic brokers from the industry, the regulatory and labor market dynamics gradually channel these brokers towards firms that hire individuals with a disproportionately high volume of customer complaints. These firms, known for their lax hiring standards and relaxed compliance standards, specialize in exploiting inexperienced investors.

Dimmock et al. [2016] in a related study find that financial fraud is contagious. They find that a broker's propensity to commit financial fraud is significantly influenced by his or her coworkers' propensity to commit fraud after controlling for firm culture, branch atmosphere, market conditions and state regulatory environment.

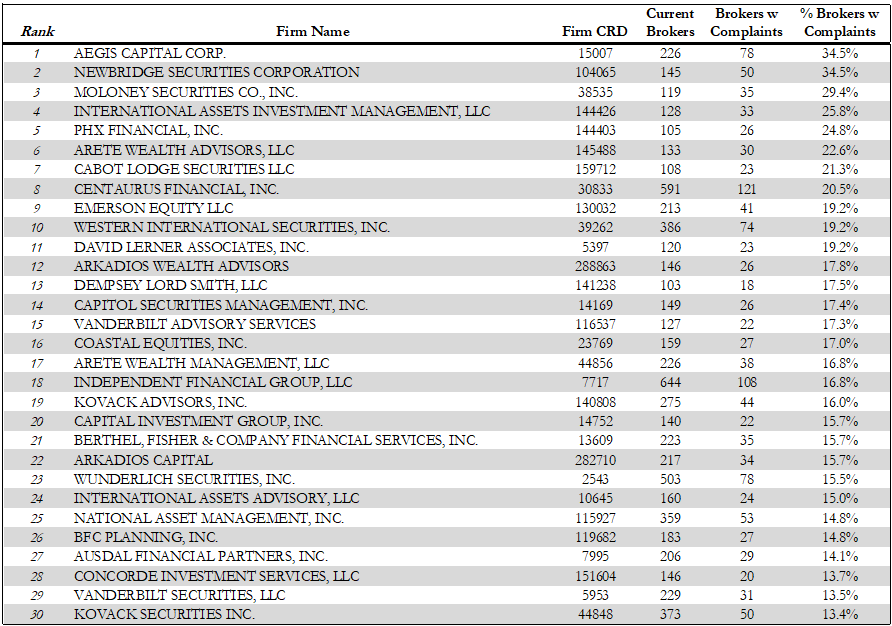

Daniel Gregory Divicos current employer,  is one of the 30 highest risk brokerage firms measured by the percent of brokers at the firm who have customer complaints disclosed on their BrokerCheck reports. 15.00% of

is one of the 30 highest risk brokerage firms measured by the percent of brokers at the firm who have customer complaints disclosed on their BrokerCheck reports. 15.00% of  's brokers have customer complaints compared to only 2.71% of all brokers who have complaints.

's brokers have customer complaints compared to only 2.71% of all brokers who have complaints.

If you have questions about this post, about

and/or Daniel Gregory Divico or about the management of your accounts, please contact SLCG for an initial consultation or email us at

BrokerInquiry@SLCG.com.

SLCG Economic Consulting, LLC ("SLCG") specializes in finance, economics, and investment management consulting services. We offer expert witness services tailored to meet the needs of law firms, banks, brokerage firms, and individuals navigating complex litigation. Our team predominantly comprises PhD and MA-level professionals with varied backgrounds spanning academia, industry, and government. Numerous team members have offered expert testimony in state and federal courts, as well as in diverse arbitration forums.

SLCG is a wholly owned subsidiary of McCann Yan Holdings, Inc., a Virginia incorporated company based in Northern Virginia.

Reference:

[1] S. Dimmock, W. Gerken, and N. Graham. "Is Fraud Contagious? Co-Worker Influence on Misconduct by Financial Advisors" The Journal of Finance Vol. 73, No. 3 June 2018.

[2] M. Egan, G. Matvos, and A. Seru. "The Market for Financial Adviser Misconduct". Working paper, Journal of Political Economy Volume 127, Number 1, February 2019.

[3] C. McCann, C. Qin and M. Yan. "How Widespread and Predictable is Stock Broker Misconduct?" The Journal of Investing, Volume 26, Issue 2, Summer 2017.

[4] H. Qureshi and J. Sokobin. "Do Investors Have Valuable Information About Brokers?". Working paper, August 2015.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2652535